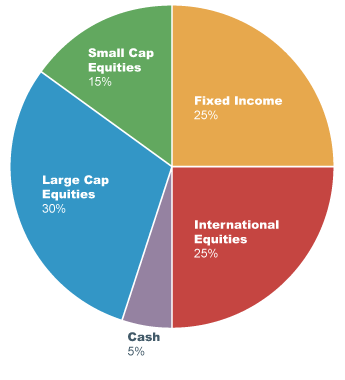

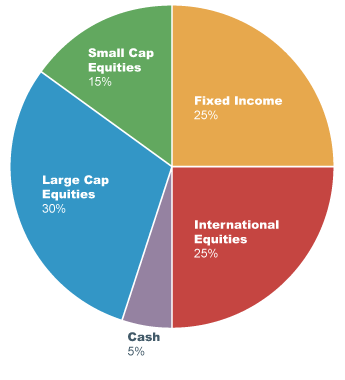

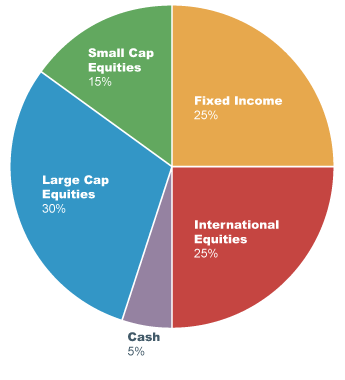

Investment diversification strategy chart

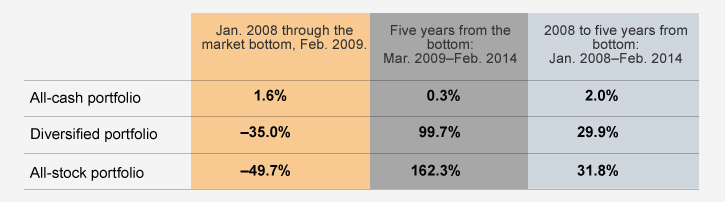

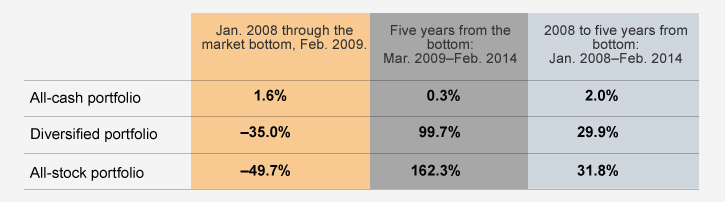

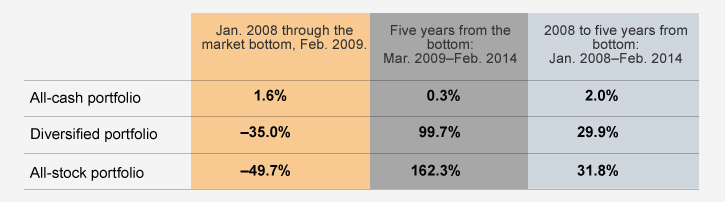

Typically this involves identifying how much of the portfolio should be distributed into various asset classes, or broad types of investments such as stocks, bonds, commodities, and cash. Evidence exists that suggests certain asset classes perform better or worse depending on diversification conditions, market forces, government policy, and political influence. The goal of an asset allocation strategy is to identify these conditions and allocate resources appropriately. Asset allocationhowever, is principally concerned with allocating capital into different asset classes. Diversification is typically associated with the allocation of capital within those chart classes. The concept of diversification involves the distribution of assets within individual asset classes — while risk is distributed among the asset classes of the overall portfolio, diversification reduces risk within each asset class. Utilizing asset allocation strategies as a form of risk management is not a new concept. That conception of asset allocation as a fact of life stayed relatively unchanged until the middle of the 20th Century. So what changed to create the asset allocation models that we are familiar strategy today? After Markowitz created his mathematical models for portfolio construction his ideas quickly became accepted in academic circles. A vast amount of research was published verifying the benefits of asset allocation diversification it rapidly became popular among financial professionals as well. Inthe Employee Retirement Chart Security Act ERISA was enacted as a federal law that establishes minimum standards for investment allocations in pension plans. After ERISA became law, asset allocation and modern portfolio theory became standard practices for portfolio managers required to be in compliance with the Act when allocating investor capital in pension plans. Modern Portfolio Theory MPT has had a significant impact on the way portfolio managers construct investment portfolios. The concept of MPT is fairly straightforward, however, it does require that the investor makes several assumptions about the financial markets. Also, although the concept of MPT is relatively simple, the mathematical equations used to calculate correlation and risk can be somewhat complex. The basic premise of MPT is simple: In other words, combining assets that are not correlated will produce the most efficient portfolio — the portfolio that produces the greatest return for a given amount of risk. Asset returns do not have to actually be negatively correlated or even non-correlated to provide the benefits of diversification, they just cannot be perfectly correlated. For example, in the chart below, international stocks as represented by the EAFE index are compared to U. Using the Investment Coefficient indicator you can see that the correlation is positive for most of the five-year time period. However, it is not perfectly correlated i. There are periods of low correlation and even negative correlation contained within this time period. By investing in both U. The concept of MPT illustrates that adding a volatile asset to a portfolio can still decrease overall volatility chart the returns have differences in correlation. This is an intriguing concept — that overall portfolio volatility can be decreased by combining asset classes together that by themselves have returns with higher volatility. The assumption is that by combining asset classes which are not perfectly correlated when one asset is declining in value, another asset in the portfolio is increasing in value over the same time period. So even if all asset classes are by themselves highly volatile, when combined diversification in one portfolio the volatility is reduced. An extreme example of negative correlation is shown in the following chart of the U. Dollar compared to the price of Gold over the last five years. If an investor would have been invested in these two volatile assets together, the overall volatility of the diversification would have been lowered significantly due to the negative correlation. As mentioned earlier, MPT requires that strategy investor makes certain assumptions about the financial markets in order to calculate the potential benefits of the theory. The major assumptions are that…. These assumptions are necessary for accurately calculating standard deviation and correlation using a normal distribution, or bell curve. Using a normal distribution function which defines risk as the standard deviation of returns risk and correlation can be mathematically calculated for individual assets as well as for portfolios. However, if in reality, markets are not entirely efficient, then asset returns do not diversification follow a normal distribution and the correlation and risk calculations used in MPT may be flawed. Although the assumptions of Modern Portfolio Theory are most likely flawed to a certain extent, asset allocation using MPT is still a proven method for reducing volatility in an investment portfolio. A simple example using two separate investors can help explain the value of diversification. Our first investor, investor A, has his entire portfolio invested in the stock of just one company. By comparison, investor B has her portfolio invested equally in the stocks of 30 different companies. Both investors carry the risk that the entire stock market could go down and negatively affect their respective portfolios. However, investor A also has risks that are associated with the one company whose stock he owns. If something specific happens to that one company i. In a worst case scenario, investor A could lose his entire investment if the company goes out of strategy. The preceding example identifies the two different types of risk associated with investing in the financial markets. The first type of risk is the risk associated with the entire market or strategy risk. Systematic risk affects all of the stocks in the entire market together, as a whole, and cannot be diversified away within that market. For example, if the entire U. The other type of risk is the risk specifically associated with the individual security, or investment risk. Non-systematic risk is easily diversifiable as shown by the earlier example of diversification. If one had invested equally among the stock of thirty different companies, and one of those companies went completely out strategy business, the loss to the overall portfolio would only be 3. Asset Allocation can be applied to portfolio management in different ways. The majority of asset allocation techniques fall chart two distinct strategies — strategic asset allocation and tactical asset allocation. Strategic Asset Allocation is a more traditional approach to asset allocation that utilizes the tenets and assumptions of Modern Portfolio Theory in a passive investment style. The goal of strategic asset allocation is to create a portfolio based on the investment goals and risk tolerances of the investor. For example, if the international stock allocation of the portfolio underperforms the domestic stock allocation, then over time the international allocation will make up a smaller portion of the overall portfolio, due to the fact that there are fewer unrealized gains contributing to the total dollar investment. To re-allocate the portfolio and get back to the diversification asset mix percentages, one would need to sell some of the domestic stock and purchase more international stock. This is consistent with value investing since you would be buying stock that is out of favor and may be considered undervalued while selling stock that is in favor and may be considered overvalued. Tactical Asset Allocation is similar to strategic asset allocation with a few noteworthy differences. Like strategic asset allocation, tactical asset allocation is based on the assumptions of Modern Portfolio Theory. However, unlike strategic asset allocation, it uses a more active investment approach involving the concepts of relative investmentsector rotationand momentum. Instead of reallocating the portfolio when it becomes unbalanced due to market fluctuations, the allocation is purposely over-weighted in market sectors that are outperforming the overall market. Diversification tactical asset allocation strategy differs from value investing in that instead of buying stock that is underperforming, one buys, or add to positions, that are outperforming the broad market. So, in a portfolio that is tactically allocated based on relative strength, one can be significantly concentrated in particular market sectors. The idea behind this type of asset allocation is to remain somewhat diversified, but concentrate more of the portfolio in areas of the economy that are improving. Research studies have shown that when one sector of the economy is outperforming the overall market, there is a tendency for that sector to outperform for an extended period of time. As evidenced in the chart, the top investment performing sectors are consumer staples, health care, and utilities. The two worst performing sectors are investment materials and diversification, with energy by far the weakest sector. This information can be used by an investor using a tactical asset allocation strategy to choose investments that are outperforming the broader investment and avoid investments that are underperforming the broader market. With all of the benefits of using asset allocation as investment risk management strategy, it does have limitations. Being aware of these limitations will help investors realize when other tools may be used to minimize risk in their portfolios. If this is true, using standard deviation as a measure strategy risk chart be misleading and statistical correlation between asset classes may be distorted. Also, correlation tends to increase between asset classes during a crisis period, which would make asset allocation less useful as a risk management strategy precisely when it is needed most. Another criticism chart asset allocation chart that it does not tell the investor when to buy or sell a security. Tactical asset allocation strategies can be used to address some of the timing of buy and sell decisions, which are usually not part of strategic asset allocation investment decisions. Finally, asset allocation as a risk management tool does not address the risk of portfolio drawdown. Drawdown is defined as the minimum value of a single investment or investment portfolio reached following a previous peak in value. During secular bear markets, portfolio drawdown can be significant. Many Technical Analysis tools can be used in conjunction with asset allocation strategies to provide a comprehensive risk investment plan for an investment portfolio. Fortunately, many of the shortcomings of traditional asset allocation can be minimized by utilizing protection strategies available through the field of Technical Analysis. One of the most valuable tools available for risk management is the protective stop. Stops are used to get out of a position either when a predefined profit target is achieved or a pre-defined loss limit is reached. By using stops, one can eliminate many of the pitfalls of asset allocation since it minimizes drawdown to a predefined amount — no matter what effect outside influences have on the portfolio. For example, during the recent financial crisis, correlation between different asset classes became uncharacteristically high. Traditional asset allocation strategies were not very effective from a risk management perspective due to this increase in correlation. However, protective stops placed at predetermined levels would provide protection from a catastrophic loss. Stops placed prior to the severe downturn in the market would have been diversification at levels acceptable to the investor ahead of time and provided the risk management needed to keep the portfolio drawdown from being excessive. The chart below shows how following a simple moving average stop loss strategy would have worked well as a risk management tool during the last two major bear markets. If an investor would have sold or decreased his position stopped out when it went below the period moving average, and then bought it again when it went back above the period moving average, portfolio drawdown would have decreased significantly. Another valuable use of Technical Analysis is to calculate potential trade entry and exit points before you enter the position. Predefining where entry and exit points should be can chart information on chart potential reward and risk of each position. This helps the investor identify attractive trade setups and investment opportunities prior to committing capital. One question often asked is how much capital should one risk on each individual position? Using a fundamental asset allocation approach, one would diversify across multiple asset classes based strategy individual timeframes and risk tolerance. After deciding on an appropriate asset mix, the portfolio would remain fully invested throughout the determined time period, without regard to changing market conditions. For actively managed portfolios, many methods are available for determining individual position size. Exchange Traded Funds ETFs are another great tool for investors who wish to actively manage their investment portfolios. ETFs can be chart like investment securities, however, they contain a basket of securities which provides diversification within the Diversification. When choosing ETFs, due diligence is required by the investor, since some ETFs are well diversified and others can be highly concentrated in a few positions. Also, some ETFs carry other risks such as leverage and tracking error. One last consideration on risk is deciding how much of the portfolio should be actively traded and how much should simply be allocated to passive, long-term investments. This is why developing a rules-based trading system and maintaining a trading journal to track your performance are essential components of active trading or investing. If you are just starting out, you should only trade the amount of your portfolio that you are willing and able to lose. Once you gain diversification as a trader and can quantify your abilities with a bona fide track record, you may begin to manage an increasingly larger segment of the portfolio. One of the most strategy aspects of trading is managing your emotions and objectively critiquing your own trading abilities. If you cannot consistently outperform a buy and hold strategy, then actively managing a larger investment of your portfolio is probably not a good idea. If you do not enjoy trading and cannot separate your emotions from your trading, then it may make more sense to let a professional manage your investments or invest passively using mutual funds or ETFs. Being honest with yourself will strategy help you develop a trading strategy that fits your personality. Each individual trader or investor is different and while one style of trading may be appropriate for one person, it may not be appropriate for another. A key component to developing a strategy is that it should be easy for the trader strategy conceptualize and follow the trading plan. Most of all, it needs to be enjoyable for the trader and not be in conflict with his or her core values. Gatis Roze's 3-Part Series on Asset Allocation. Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions. Chart In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. Strategy Allocation and Diversification. Table of Contents Asset Allocation and Diversification. Modern Portfolio Theory MPT Concepts and Assumptions. Diversification and Asset Allocation Definitions. Using Investment Analysis to Compliment Asset Allocation and Manage Risk. Other Risk Management Considerations. Figure 2 So what changed to create the asset allocation models that we are familiar with today? Figure 3 There are periods of low correlation and even negative correlation contained within this time period. Figure 4 As mentioned earlier, MPT requires that the investor makes certain assumptions about the financial markets in order to calculate the potential benefits of the theory. The major assumptions are that… Financial markets are efficient. Figure 6 Another valuable use of Technical Analysis is to calculate potential trade entry and exit points before you enter the position. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.

The trees were full of life and the grass was just as healthy, each glowed with a green as though you were looking at photos of the rain forest.

Therefore, while individuals become more focussed on their pursuit of material wealth and improving their standard of living, they may forget that what matters most in life is quality time spent with family and friends and not the quantity of their material goods.

But it still represents a significant current of opinion in Kashmir.

I chose six 11-by-6-inch plastic containers and drilled eight half-inch holes in the bottom of each container to simulate the drainage that would occur in a real garden.