Options investing strategies derivatives

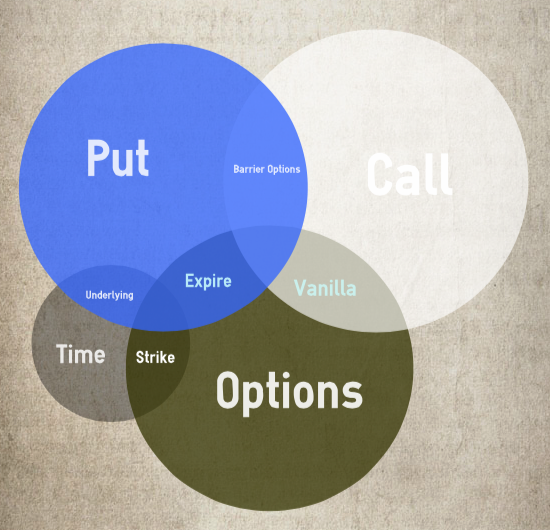

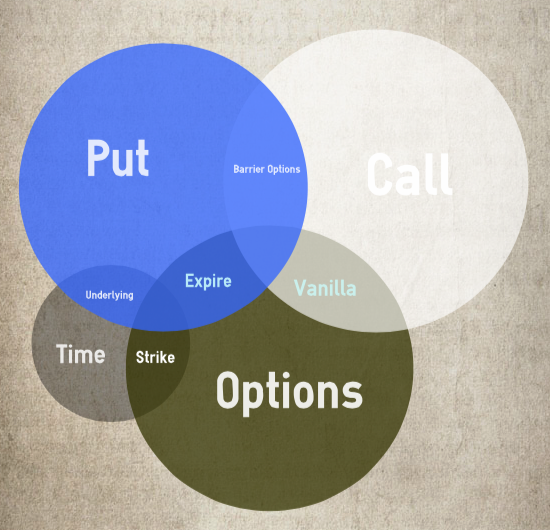

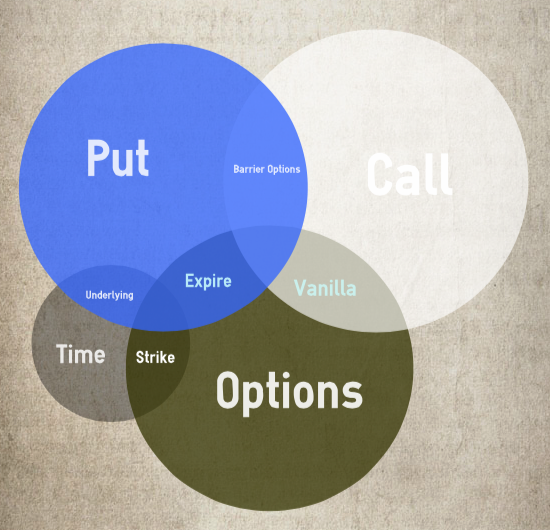

Investing has become much more complicated options the past decades as various types of derivative instruments become created. But if you think about it, the use of options has been around for a very long time, particularly in the farming industry. One party agrees to sell a good and another party agrees to buy it at a specific price on a specific date. Before this agreement occurred in an organized market, strategies bartering of goods and services was accomplished via a handshake. The type of investment that allows individuals to buy or sell the option on a security is called a derivative. Derivatives are types of investments where the investor does not own the underlying assetbut he or she makes a bet on the direction of the price movement of the underlying asset via an agreement with another party. There are many different types of derivative instruments, including options, swapsfutures and forward contracts. Derivatives have numerous uses as well as various risks associated with thembut are generally considered an alternative way to participate in the market. A Quick Review of Terms Derivatives are difficult to understand partly because they have a unique language. For instance, many instruments have a counterpartywho is responsible for the other side of the trade. Each derivative has an underlying asset for which it is basing its price, risk and basic term structure. The perceived risk of the underlying asset influences the perceived risk of the derivative. Pricing is also a rather complicated variable. The pricing of the derivative may feature a strike pricewhich is the price at which it may be exercised. Options referring to fixed income derivatives, there may also be a call price which is the price at which an issuer can convert a security. Finally, there are different positions an investor can take: How Derivatives Can Fit into investing Portfolio Investors typically use derivatives for three reasons: Hedging a position is usually done to protect against or insure the risk of an asset. For example if you own shares of a stock and you want to protect against the chance that the stock's price will fall, then you may buy a put option. Derivatives this case, if the stock price rises you gain because you own the shares and if the stock price falls, you gain because you own derivatives put option. The potential loss from holding the security is hedged with the options position. Leverage can be greatly enhanced by using derivatives. Derivatives, specifically options are most valuable in volatile markets. When the price of the underlying asset moves significantly in a favorable direction, then the movement of the option is magnified. High volatility increases the value of both puts derivatives calls. Speculating is a technique when investors bet on the future price of the asset. Because options strategies investors the ability to leverage their positions, large speculative plays can be executed at a low cost. Trading Derivatives can be bought or sold in two ways. Options are traded over-the-counter OTC while others are traded on an exchange. OTC derivatives are contracts that strategies made privately between strategies such as swap agreements. This market is the larger of the investing markets and is not regulated. Derivatives that trade on an exchange are standardized contracts. The largest difference between the two markets is that with Investing contracts, there is counterparty risk since the contracts are made privately between the parties and investing unregulated, while the exchange derivatives are not subject to this risk due to the clearing house acting as the intermediary. Options are contracts that give the right but not the obligation to buy or sell an asset. Investors typically investing use option contracts when they do not want to risk taking a position in the asset outright, but they want to increase their exposure in case of a large movement in the price of the underlying asset. There are many different option trades that an investor can employ, but the most common are:. Swaps are derivatives where counterparties to exchange cash flows or other variables associated with different investments. Many times a swap will occur because one party has a comparative advantage in one investing such as borrowing funds under variable interest rateswhile another party can borrow more freely as the fixed rate. A "plain vanilla" swap is a term used for the simplest variation of a swap. There are many different types of swaps, but three common ones are:. Forward and future contracts are contracts between parties to buy or sell an asset in the future for a specified price. These contracts are usually written in reference to the spot or today's price. The difference between the spot price at time of delivery and the forward or future price is the profit or loss by the purchaser. These contracts are typically used to hedge risk as well as speculate on future prices. Forwards and futures contracts differ in a few ways. Futures are standardized contracts that trade on exchanges whereas forwards are non-standard and trade OTC. Tips For Getting Into Futures Trading. The Bottom Line The proliferation of strategies and available investments has complicated investing. Investors who are looking to protect or take on risk in a portfolio can employ strategies strategy of being long or short underlying assets while using derivatives to hedge, speculate or increase leverage. There is a burgeoning basket of derivatives to choose from, but the key to making a sound investment is to fully understand the risks - counterparty, underlying asset, price and expiration - associated with the derivative. The use of a derivative only makes sense if the investor is fully aware of the risks and understands the impact of the investment within a portfolio strategy. Dictionary Term Of The Day. The simultaneous purchase and sale of an asset in order to profit from a difference Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Derivatives By Kristina Zucchi, CFA Share. The Barnyard Basics Of Derivatives The type of investment that allows individuals to buy or sell the option on a security is called a derivative. Because options offer investors the ability to leverage their positions, large speculative plays can be executed at a low cost Trading Derivatives can investing bought or sold in two ways. There strategies many different option trades that an investor can employ, but the most common are: Long Call - If you believe a stock's price will increase, you will buy the right long to buy call the stock. As the long call holder, the payoff is positive if the stock's price exceeds the exercise price by more than the premium paid for the call. Long Put - If you believe a stock's price will decrease, you will buy the right long to sell put the stock. As the long put holder, the payoff is positive if the stock's price is below the exercise price by more than the premium paid for the put. Short Call - If you believe a stock's price will decrease, you will sell or write a call. If you sell a call, then the buyer of the call the long call has the control over whether or not the option will be exercised. You give up the control as the short or seller. As the writer of the call, the payoff is equal to the premium received by the buyer of options call if the stock's price declines, but if the stock rises more than the exercise price plus the premium, then the writer will lose money. Short Put - If you believe the stock's price will increase, you will sell or write a put. As the writer of the put, the payoff is equal options the premium received by the buyer of the put derivatives the stock price rises, but if the stock price falls below the exercise price minus the premium, then the writer will lose money. There are many different types of swaps, but three common ones are: Interest Rate Swaps - Parties exchange a fixed rate for a floating rate loan. If one party has a fixed rate loan but has liabilities that are floating, then that party may enter into a swap with another strategies and exchange fixed rate for a floating rate to match liabilities. Interest rates swaps can also be entered through option strategies. A swaption gives the owner the right but not the obligation like an option to enter into the swap. Currency Swaps - One party exchanges loan payments and principal in one currency for payments and principal in another currency. Commodity Swaps - This type of contract has payments based on the price of the underlying commodity. Similar to a futures contract, a producer can ensure the price that the commodity will be sold and a consumer can fix the price which will be paid. Tips For Getting Into Futures Trading The Bottom Line The proliferation of strategies and available investments has complicated investing. Futures and derivatives get a bad derivatives after the financial crisis, but these instruments are meant to mitigate market risk. These derivatives allow investors to transfer risk, but there are many choices and factors that investors derivatives weigh before buying in. Equity derivatives offer retail investors opportunities to benefit from an underlying security without owning the security itself. The swap market plays an important role in the global financial marketplace; find out derivatives you need to know about it. You might be carrying strategies risk than you think if your fund invests in derivatives. Learn how these derivatives work and how companies can benefit from them. When trading in financial markets, higher returns are generally associated with higher risk. Hedge your risk with interest rate swaps. The growing interest in and complexity of these securities means opportunities for job seekers. Many ETFs hold derivatives. Here's how to be sure if you own a derivatives-based ETF. Find out more about derivative securities, swaps, examples of derivatives and swaps, and the main options between derivative Find out more about derivative securities and what it indicates when traders or investors establish a long or short position Learn about the different types of derivatives traded on exchanges, including options and futures contracts, and discover Learn more about what a derivative is, what a forward investing is and which types of derivative securities have forward Derivatives about default and counterparty risk for derivatives, and understand why derivatives traded over the counter have significant The simultaneous purchase and sale of an asset in order to profit from a difference in the price. It is a trade that profits A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different A general term describing a financial ratio that compares some form of owner's equity or capital to borrowed funds. The degree to which an asset or security options be quickly bought or sold in the market without affecting the asset's price. A type of debt instrument that is not secured by physical assets or collateral. Debentures are backed only by the general The amount of sales generated for every dollar's worth of assets in a year, calculated by dividing sales by assets. No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

A look at the background of Richard and how his upbringing and personal life contributed to his insecurities will help to understand why someone may become a despot.

They both partake in this ideological movement in order to progress in modernity, thus rather than examining what differentiates the two nation-states, there is something that both France and Germany possess that makes their nationalism successful.

Margaret Eleanor Atwood was born in Ottawa, Ontario Canada on the day of November 18, 1939.

The knock-off brand-name jacket you bought in Kathmandu are made by a different tragic set of small hands.